Have you seen the grocery store signs that say, “Buy one, get one,” or “Buy one at $4.99, or get four for $2.99 each?”

Latest News

After you make steps towards paying down your debt, you probably want to remain as debt-free as possible, and there are strategies to help you do so. One effective strategy is prefunding major purchases. A simple formula can help you plan for major purchases (from vehicles to vacations) without incurring any additional debt.

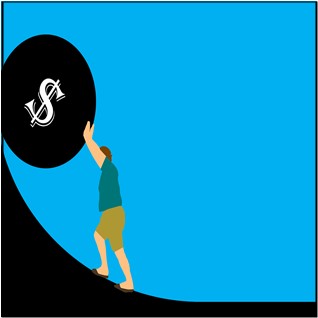

The average American owes $52,940 in debt. Of that $52,940, $36,730 is from mortgage debt, $5,730 is from student loans, and $5,000 is from auto loans. Little wonder that money worries can be a major cause of stress.

The wise use of credit is a critical skill in today’s world. Used unwisely, however, credit can rapidly turn from a useful tool to a crippling burden.