Have you seen the grocery store signs that say, “Buy one, get one,” or “Buy one at $4.99, or get four for $2.99 each?”

It’s a concept called “spaving,” a time-tested marketing strategy that combines spending and saving. It is designed to get consumers to spend more, perhaps more than they wanted, under the guise of saving money.

Spaving plays on your emotions, designed to promote an impulse buy because even the most disciplined shopper may be unable to pass up a deal. In some instances, the price-cutting promos work great for the consumer. But other times, “spending more money to save money” does not make sound financial sense.

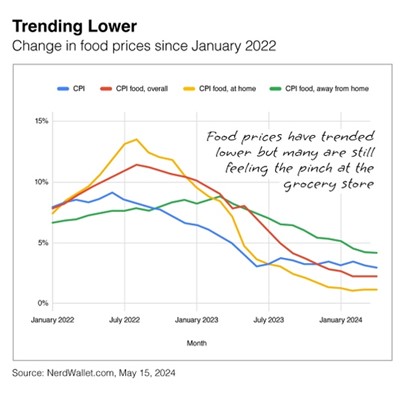

The accompanying chart shows that food prices have decreased since mid-2022 as companies have resolved food production costs, labor costs, and supply chain issues. The Consumer Price Index for “food at home” has been tracking right around 1% this year, but the recent price stability doesn’t offset the food inflation in 2021 and 2022.

Other retailers are starting to feel the heat from bargain hunters, too. In recent months, Target, McDonald’s, and several others have cut prices as shoppers become more selective about spending as their budgets get squeezed.

If you are feeling the pinch, please let us know. Sometimes, even the slightest change can make a big difference. We work with individuals and families of all budgets to find the financial strategies that are right for you.

Sources:

FoxBusiness.com, May 19, 2024. “Finance expert sounds alarm over ‘spaving’ trend: An old ‘trap’ with a new name hitting your wallet.”

NerdWallet.com, May 15, 2024. “Food Prices Stayed Flat in April. Groceries Actually Declined.”

CNBC.com, May 22, 2024. “Why Target and McDonald’s are cutting prices and offering deals.”

Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this content, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for you or your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Allos Investment Advisors®, LLC.

The content of this letter does not constitute a tax or legal opinion. Always consult with a competent professional service provider for advice on tax or legal matters specific to your situation. To the extent that a reader has any questions regarding the applicability of any specific issue discussed in this content, he/she is encouraged to consult with the professional advisor of his/her choosing.

Published for the blog on July 18, 2024 by Allos Investment Advisors®, LLC.