By Jessica Searcy Kmetty

People often ask me about my favorite budgeting app. What do you use? Does it work for you? If yes, why do you like it?

This is where I feel like health and finances are similar.

My favorite app or method is “whatever works for you and keeps you on track.”

I honestly don’t care if that’s YNAB, Mint, Excel, a LWSL planner or some other method. You simply have to find what works for you!

Having said that, and having tried several methods and apps over the years, the one I use is EveryDollar (not the upgraded version, the FREE version). I’ve been using it with my husband for the past couple of years now and have been pretty consistent with it.

The premise is simple: enter your anticipated net income (i.e., the cash from all sources that will hit your bank account), then allocate every dollar to an expense or savings “bucket.”

As you spend money throughout the month, the budget always has to balance, so if you overspend in one category, you have to make it up from another category and so it becomes a living plan.

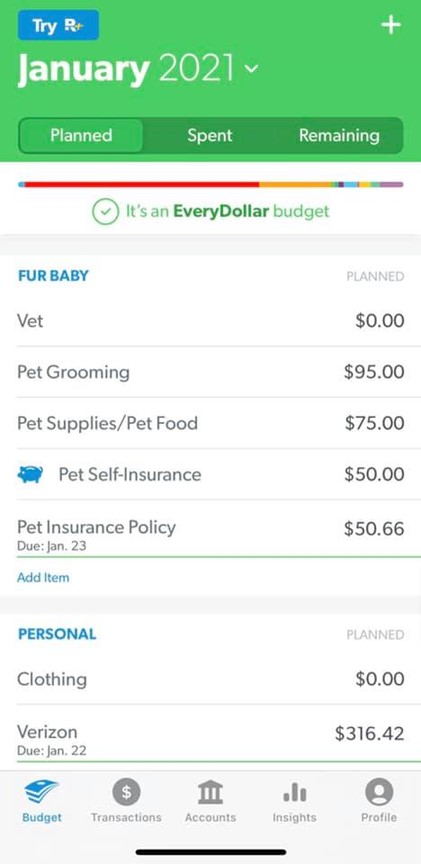

Here’s a screen shot. The piggy bank icon indicates a savings bucket. Once I have a sufficient amount saved in that bucket, I’ll cancel our dog’s insurance and self-insure going forward (reallocating what we currently spend on premiums). You can also set due dates on recurring bills.

After creating the budget, I enter transactions as they occur and the green line beneath each category shows you how close to the budget you get, turning red when you overspend.

If you have struggled with budgeting in the past, I encourage you to think about how you manage other areas of your life. Perhaps you’ll uncover a method of tracking and budgeting that’s already working for you in other areas. You don’t have to struggle with making the most recommended method work in your life if it just doesn’t fit. Find what works and go with it!

Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this content, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for you or your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Searcy Financial Services, Inc.

The content of this letter does not constitute a tax or legal opinion. Always consult with a competent professional service provider for advice on tax or legal matters specific to your situation. To the extent that a reader has any questions regarding the applicability of any specific issue discussed in this content, he/she is encouraged to consult with the professional advisor of his/her choosing.

Published for the blog on January 26, 2021 by Searcy Financial Services, your Overland Park, Kansas Fee-Only Financial Planner and Investment Manager.