Personal finance goals look a little different when you’re in your 20s and 30s. While your parents are focused on managing retirement, you might be navigating the challenges of paying off student-loan debt, establishing yourself in a new career, buying a home, and having a family.

You may think that you have all the time in the world to set up a financial strategy, but time goes by more quickly than you expect. Working with a financial professional may help get you out of debt faster, save for important goals, and give you a head start on retirement.

So where do you begin? Here are six moves to consider to jump-start your financial future.

01. TAKE CONTROL OF YOUR HEALTH

Wait, what? It may seem counterintuitive, but your health plays a huge part in your financial well-being. If you are not currently covered by health insurance, you should consider making it a financial priority. Even if you are generally healthy, a car accident or unexpected illness can set you back financially.

Studies show that young Americans (age 18–34) are the age group most likely to go without health insurance. According to the Centers for Disease Control and the U.S. Census Bureau, 14.3 percent of 19-to-25-year-olds and 13.9 percent of 26-to-34-year-olds have no health insurance.

If you are under the age of 26, you may be able to get coverage through a parent or a guardian. If you are not eligible for an employer-sponsored health insurance plan or your parents’ insurance, you can shop for health insurance plans on the Affordable Care Act (ACA) federal or state insurance exchanges. Visit www.healthcare. gov to get started.

02. NEGOTIATE YOUR SALARY

One of the savviest financial plays you can make early in your career is to learn how to negotiate a salary. Since your employers will base subsequent raises and job offers on your previous salary, you can improve your lifetime wealth dramatically by negotiating for a higher salary early on.

Here are some negotiating tips for boosting your salary:

- Do not be afraid to ask for a raise or salary bump.

- Demonstrate why you are worth more money.

- Do your homework so you understand the market for your skills.

- Ask for written goals, and set a future date for a review if your request is initially declined.

- Consider salary alternatives, such as performance bonuses and noncash perks, that can improve your lifestyle.

03. FIGURE OUT YOUR FINANCIAL GOALS

Do you dream of owning a home? Do you want to travel every year? Do you want your children to go to college?

Whatever your personal goals are, you’ll need to prepare for them.

Your Goals Might Include the Following:

Additional education: College, graduate school, and advanced certificate programs can open doors and boost your career prospects. However, tuition and fees for public, four-year colleges have been increasing by an average of 8% each year. Living expenses and little or no income (depending on your employment status as a student) will also raise the cost of education. Preparing now can help ensure a strategy to balance your college savings and loan needs.

A house: Owning a house is still the dream for many young Americans. For most people, a house will be the largest purchase they ever make. Now is the time to prepare by thinking about a down payment, learning about your credit score (and fixing it if necessary), and studying market trends in your area.

A business: If you aspire to be an entrepreneur, preparing financially may help you get ahead. Create the vision for the company you want to build, and identify the overhead you need to get started. From there, you can develop ongoing financial strategies that will help you launch a business with a sound financial standing.

04. PAY DOWN AND ELIMINATE DEBT

When they think about saving and investing, most people’s minds immediately turn to retirement. While retirement is an important goal, many other intermediate life objectives also require you to develop financial strategies.

The amount of debt that individuals from 21 to 34 years old hold is staggering: 31% of U.S. consumer debt is in the hands of this demographic. For example, the average student loan is $30,000.

School loans are not the only debt items holding younger Americans back. People born in the 1980s and 1990s hold an average credit card debt of $3,542—and they use roughly 36% of their available credit. This credit comes at a high cost. A report from the Federal Reserve revealed that the average Annual Percentage Rate (APR) for variable-rate credit cards is 14%.

If you are living with significant debt, paying it off is one of the smartest financial moves you can make. You might be paying more interest than you are likely to earn by investing.

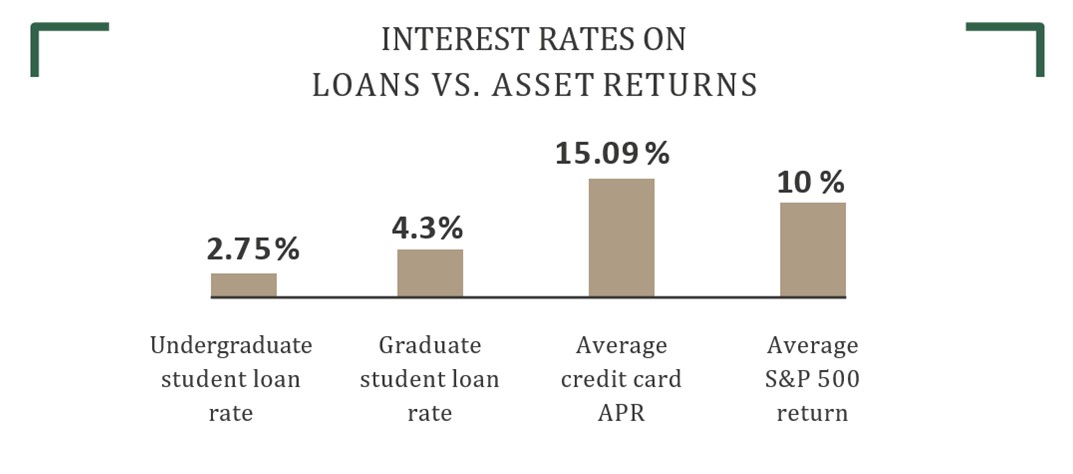

The chart below compares historical returns for investments with interest rates on school loans and credit cards.

Chart Sources: USNews.com, June 10, 2020; USNews.com, June 10, 2020; BusinessInsider.com, May 19, 2020; WalletHacks.com, March 13, 2020

You can see that the high APR on most credit cards pales in comparison with the historical performance of the market. For most people, it makes sense to pay off expensive debt instead of investing at lower rates of return. Every dollar that you pay toward your debt reduces the amount of your money that goes to interest.

Student-loan interest rates are typically lower than most other forms of unsecured debt–such as credit cards and medical bills–so deciding whether to pay down debt instead of investing is a more complex problem.

05. PROTECT YOUR CREDIT

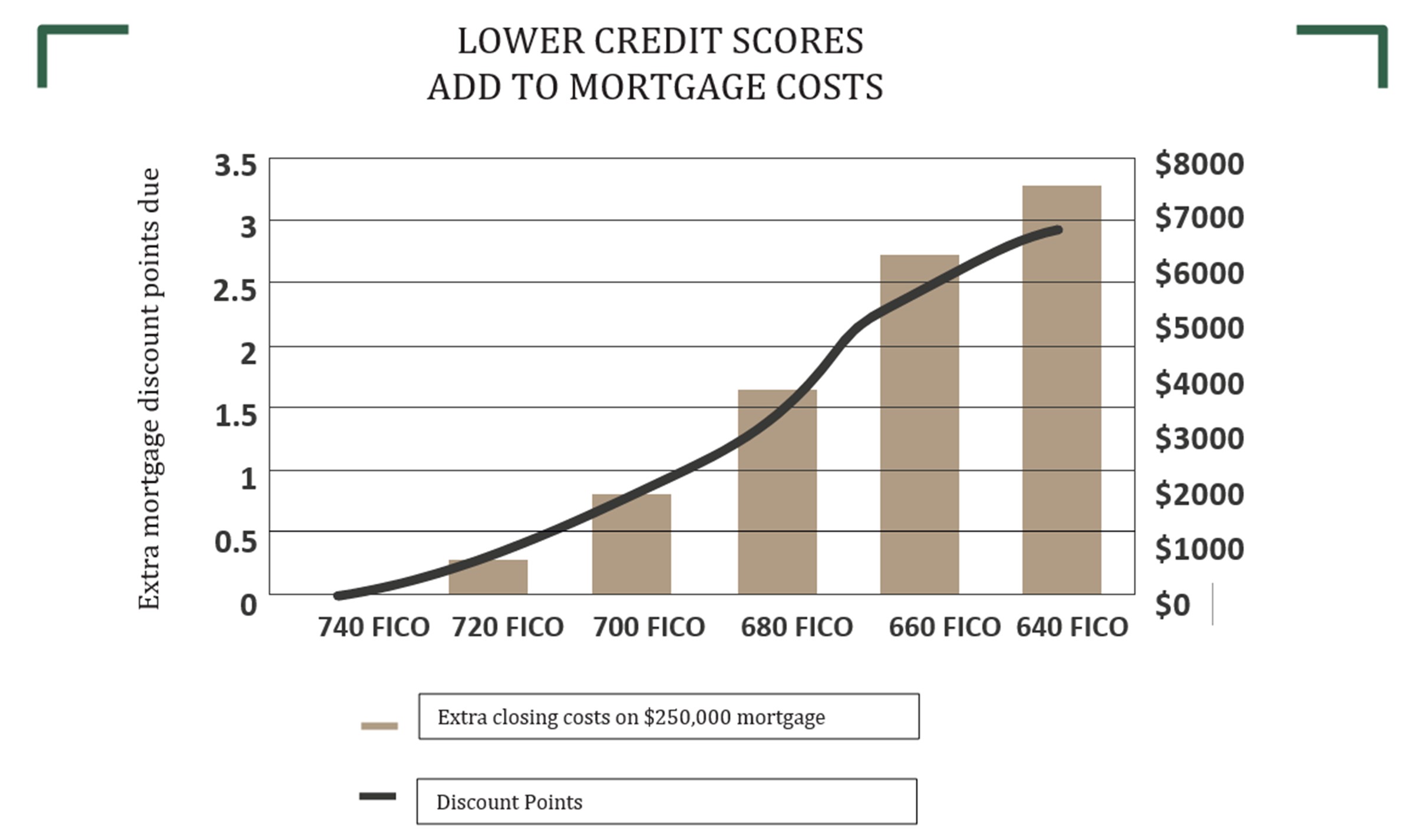

For better or worse, your credit score is one of the most important indicators of your financial health. A variety of people and institutions can use your credit to make decisions about you, such as lenders, employers, and landlords. Among other debt characteristics, your credit score can reveal whether you pay bills on time or have ever defaulted on a loan. Damaged credit can be very costly over time. The chart below shows how credit scores can affect mortgage points.

The chart below also details a $250,000 mortgage that is assessed 1 loan-discount point, resulting in $2,500 of closing costs. High credit rating scores–such as 740–show that you are a less risky borrower, while lower credit scores reveal higher risk. Remember, your FICO score is essentially your credit score. Mortgage lenders give applicants with lower credit scores a higher risk rating since lower scores indicate a higher risk of applicants defaulting on their mortgages. Thus, lenders will assign higher borrowing costs when you pose more risk to them as a borrower. This calculation translates into higher closing costs, as seen here:

For example, a credit score of 640 incurs $7,000 in closing costs, whereas a credit score of 740 incurs $0 in closing costs. Many people can’t afford to pay these extra costs at closing and choose to convert the discount points into an increased mortgage rate, raising the overall cost of the loan. Typically, every discount point converts into a 0.25% increase in mortgage interest.

Unfortunately, no secret formulas or easy fixes exist for bad credit. Rehabilitation takes time and discipline, but improving your credit is entirely possible.

Here are some simple steps that you can take now to improve and protect your credit:

- Check your credit report every year for free, and dispute any errors.

- Pay all bills on time by setting up payment reminders or enrolling in autopay when possible.

- Avoid late charges (all collections report to the credit bureaus).

- Pay down any balances on cards (high balances relative to your total available credit may impact your credit score).

- Pay off your credit cards in full each month.

06. INVEST FOR THE FUTURE

- Automate your savings: The simplest way to save is to automatically direct a portion of each paycheck into your investment accounts. You will quickly become used to your adjusted budget.

- Focus on saving a percentage of your income: Saving even 5% of your income is a great first step.

- Build a budget: If you include a monthly goal in your budget, you are more likely to stick to your strategy than if you save whatever money you have left at the end of the month.

Consider Investing

Investing is one of the best ways to grow and protect your hard-earned wealth over the long term.

Hypothetical scenario: Let’s say Joe is a 25-year-old investor who deposits $10,000 into an account. If his portfolio earns an average rate of 8% per year, that single contribution could grow to $217,245 by the time Joe is 65, even if he doesn’t add another dime to his account. However, if Joe waits until he is 35 to start investing, that same $10,000 investment would only grow to $100,627. Although this simple example that discounts the effects of fees and inflation, and it is not representative of any specific investment, the basic principle is evident: Time is one of the most important ingredients to long-term investment success.*

Investing involves risk, and the return and principal value of investments will fluctuate as market conditions change. Your investment strategy should take into consideration your goals, time horizon, and risk tolerance. When sold, investments may be worth more or less than their original cost. Past performance does not guarantee future results.

Putting your money to work through investing gives you a greater potential for return than saving alone. It is important to know that all investments involve some degree of risk. Understanding and managing risk is one of the most essential pieces of a long-term financial strategy.

As a long-term investor, it is important to develop a clear understanding of your goals, risk tolerance, and timeline. A financial professional can help you identify your risk tolerance and work with you to create an investment strategy that helps you manage risk while pursuing your long-term financial goals.

Take Your Investing to the Next Level

New investors often start out investing on their own and then turn to a financial professional when they want access to sophisticated tools, experienced advice, and help developing targeted financial goals. An investment representative can help you find the answers to important questions, like the following:

- How does my company’s retirement plan work with my other investments?

- Are there any other investment strategies that I should know about?

- Which investments are right for me?

IN CONCLUSION

We hope that you have found this guide interesting and informative. While tackling all of these financial moves at once may seem overwhelming, you can start today by focusing on small steps and establishing good habits. Remember, there’s no better time than now to start taking control of your finances.

We also want to offer ourselves as a resource to you, your family, and your friends. We are happy to talk with you about your current financial situation and future goals. If you have any questions about the information presented in this blog, please contact us. We would be delighted to speak with you.

*Diversification cannot guarantee a profit or protect against loss in a declining market.

Sources: TheBalance.com, May 27, 2020; U.S. Census Bureau, November 2019; Statistia.com, May 2020; TheBalance.com, September 27, 2019; Forbes.com, July 15, 2020; America’s Small Business Development Center, in partnership with the Small Business Administration, 2020; NPR.org, February 13, 2020; FederalReserve.gov, June 5, 2020; FoxBusiness.com, July 14, 2020

Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this content, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for you or your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Allos Investment Advisors, LLC.

The content of this letter does not constitute a tax or legal opinion. Always consult with a competent professional service provider for advice on tax or legal matters specific to your situation. To the extent that a reader has any questions regarding the applicability of any specific issue discussed in this content, he/she is encouraged to consult with the professional advisor of his/her choosing.

Published for the blog on December 7, 2020 by Allos Investment Advisors, LLC.